UBS App is now Superworks

When an employee leaves or resigns from an organization, he/she has to undergo the Full and Final Settlement Letter short form known as FnF settlement. Generally, the HR department of the organization is responsible for this F&F settlement. Full and final settlement calculation formula is a fair and non-confusing procedure that is carried out as per the labour law- Income tax guidelines mentioned in the offer letter of the employee.

When an employee leaves a company, he must be paid for the previous working month. Application for f&f full form is full and final Settlement refers to the process of paying or recovering during the resignation process.

The last working payroll month, or subsequent months, can be used for request for F & F meaning – full and final settlement process. You can either settle an employee first and then resign them, or you can resign an employee first and then do the final settlement afterward as per the request for full and final settlement.

Note: This letter will be useful to you! You can edit it, as your needs and requirements.

Full and Final Settlement Letter to Employee

Relieving from several departments such as IT, finance, HR, and administration make up the whole and final settlement. It’s also crucial to know which components to take into account after relieving date such as employee code, office address, payment dues etc when determining the employee’s ultimate dues. Before employee do the mail to hr for fnf settlement, it is the responsibility of HR to discuss and make the clear for the FNF settlement.

This entails returning corporate assets such as a laptop, monitor, keyboard, or mouse, as well as any other assets that were provided to the employee on the last day of employment. In the event of any harm, the employee fnf full and final might be held liable.

Employee accounts are changed to reflect resigned/exit ( they took exit from the company) status (where appropriate), and email addresses are removed from the IT infrastructure.

This includes any unpaid reimbursements as well as charges incurred on company credit cards. The following are the many components used to compute the employee’s ultimate dues:

Joining bonuses, learning, and development, and notice periods all have different HR regulations that vary from company to company. The joining bonus or the company’s most recent bonus may be recovered in the F&F in HR based on an employee’s performance cycle , duration or company policy.

It can be added in the fnf settlement mail to hr.

This entails obtaining an employee ID card or other relevant assets that are often required for company entry/access.

A complete and final settlement is a difficult and frequently perplexing process. Money is the most important aspect of leadership, with no other considerations. Your company should have a set of clearly defined separation procedures in place to make your payroll team’s job easier. We’ve compiled a list of policies and practices that businesses frequently employ to streamline their FnF settlement.

It’s critical to spell out your separation policies for both individuals and organizations. There should be a set of norms in place regarding the notice period, gratuity, and paid/unpaid leave encashment, among other things. These policies will assist your payroll personnel in avoiding misunderstandings. As a result, there will be fewer disagreements in the FnF settlement.

Some companies want to keep their employees’ payroll processes running regularly while withholding their compensation for the month after their departure (i.e their last working month in the organization). The partial FnF settlement method is also known as this. This method can be used since it simplifies calculations. The payroll team will only have to calculate TDS and arrears for the previous working month.

Calculating each employee’s payroll separately can be a time-consuming operation for firms that are developing quickly or that are laying off a large number of employees at the same time. Companies opt for a bulk settlement approach when the volume of FnF settlements grows. Bulk settlements enable businesses to process employee arrears in batches rather than one by one.

Resignation Acceptance Letter – Format, Meaning, Importance, and More

HR employees and senior managers are frequently entrusted with calculating full and final settlement of employee. Smaller businesses may conduct each employee’s FnF payout independently, but larger businesses frequently process FnF settlements in batches.

The term “full and final settlement” refers to the sum of all of the foregoing calculations. Calculating your employee’s leftover salary, deducting taxes from it, and clearing out your employee’s paid leaves, arrears, and Provident Fund accounts are all part of it. These computations are rarely done manually by businesses.

They calculate the refund amount in a neat and orderly manner using powerful and trustworthy software. An FnF settlement letter is used to summarize the complete procedure at the end of it.

The final settlement must be cleared on the employee’s last working day in the organization, according to the guidelines. However, clearances and paperwork take time, so this isn’t always the case in practice. The settlement period might run anywhere from 35 to 45 days after an employee’s last day at the company. The company must clear gratuity within 30 days. Any additional bonuses must also be reported within the same fiscal year.

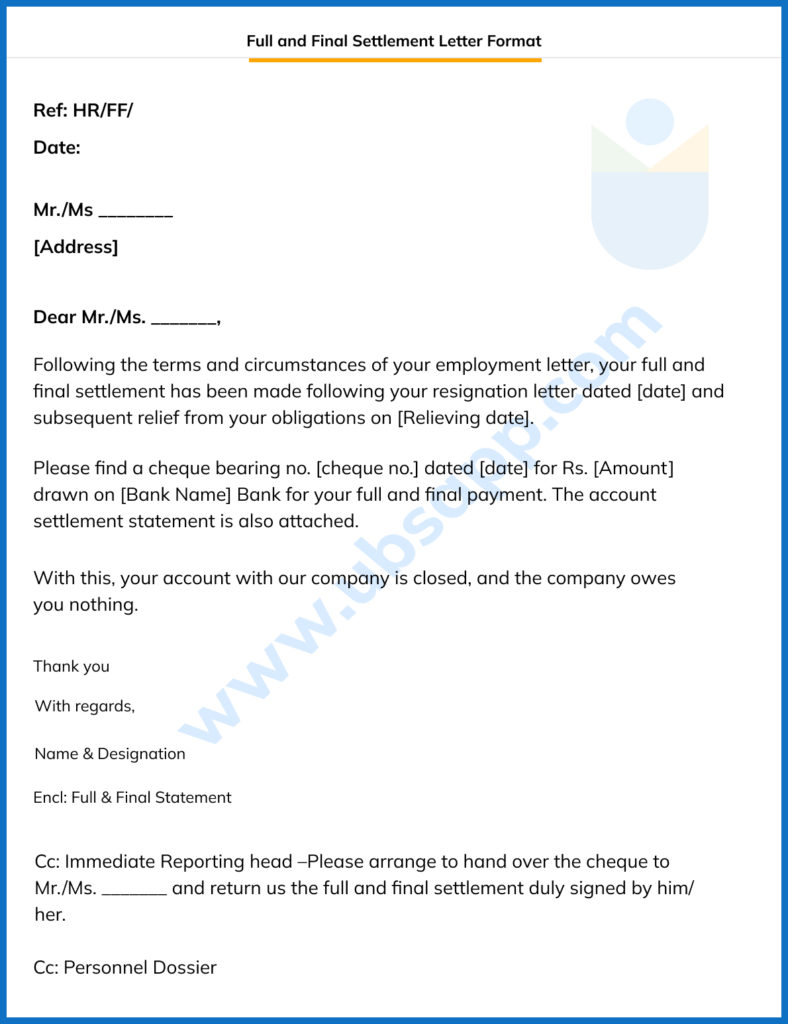

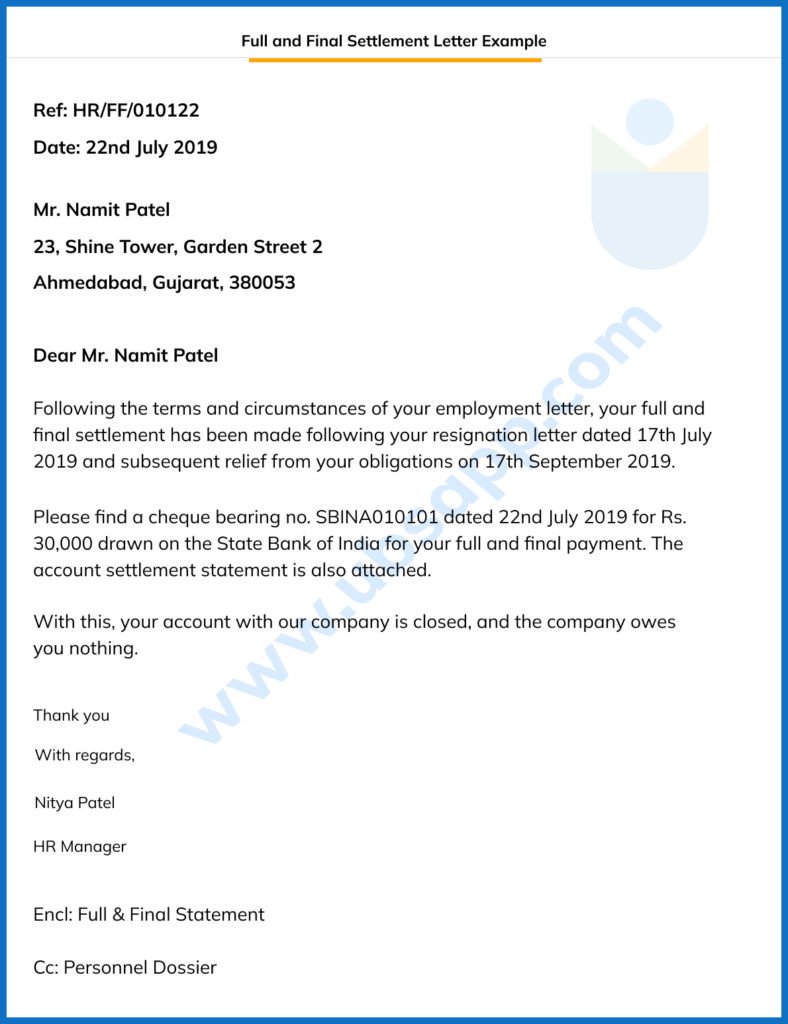

This request letter contains payment instructions for the Full and Final Settlement Letter. This letter confirms that the appropriate resignation letter has been accepted by corporate management or after the termination letter issued by management. As a result, effective from the relief date mentioned in the letter, the employee is relieved and relieving letter is given of their duties within the organization hr.

Download the Full and Final settlement letter from the UBS HR Toolkit in order to complete the process easily and quickly. Read further to know how do you write a settlement payment letter.

Note: This letter will be useful to you! You can edit it, as your needs and requirements.

Full and Final Settlement in its entirety is a meticulous and well-organized procedure. When done correctly, it allows a corporation to systematically let go of personnel. The FnF settlement necessitates HR competence as well as exact mathematics. In today’s world, businesses rely on custom-made HRMS software. They may speed up their FnF procedure and avoid any mathematical errors by using the Payroll software. Also, this software may help HRs access the Full and Final Settlement Letter format to keep the employees updated.

FnF can also be made simple if an organization’s rules, policies, and frameworks are clearly defined and articulated. Furthermore, all disagreements that arise during an FnF process must be resolved in writing. Following all of FnF’s rules and principles will assist a company to avoid paying unnecessary fees and achieve maximum growth.

Internal deadlines are frequently set by companies with good FnF policies to achieve the FnF settlement. A thorough and final settlement procedure in which the HR department facilitates transactions between all stakeholders and resolves all outstanding issues before an employee’s last day at work is desirable.

Do you want to get access to full and final settlement from employee to HR format? Do you want to make your FnF settlement go more smoothly? Check out Ultimate Business Systems – leading HRMS Software India for the most comprehensive HR toolkit having a collection of HR letters, calculators, policies, and more! Get in touch with us, and book a live demo to see how our HRMS and Payroll Management System Works.

We are here to help you find a solution that suits your business need.

Get a visual representation of how we work!

Schedule DemoOur sales expert is just one call away to meet your needs.

Get In TouchHave a question?

Chat with Us