UBS App is now Superworks

Over the past two years, technology has become an integral part of businesses. All thanks to the novel pandemic, COVID-19.

When businesses were forced to work from home and workforces were scattered in different remote places, employers had no other option but to switch to automated HR tech.

Fast forward to 2022, automation is now a necessity more than an option.

When we talk about automation, payroll software needs no special introduction.

Today, there is no dearth of payroll software for small businesses or large ones. Any and every business can find suitable software from the market.

In such a scenario, if you are still stuck with outdated and slow payroll processing tools, you are just missing on a host of advantages such as:

All that said, let’s dive into the blog and discuss five important things you must know before switching to payroll software.

When the word payroll processing comes into the picture, many people define it as a process of computing the salaries of employees. However, payroll processing is much more than that.

The whole process of processing payroll can be tricky if a person does not know how to go about it.

That being said, processing payroll is one of the most critical business operations that include arriving at the net pay of employees after adjusting all the taxes, deductions, and more.

To process payroll efficiently, an HR manager should carry out every step systematically.

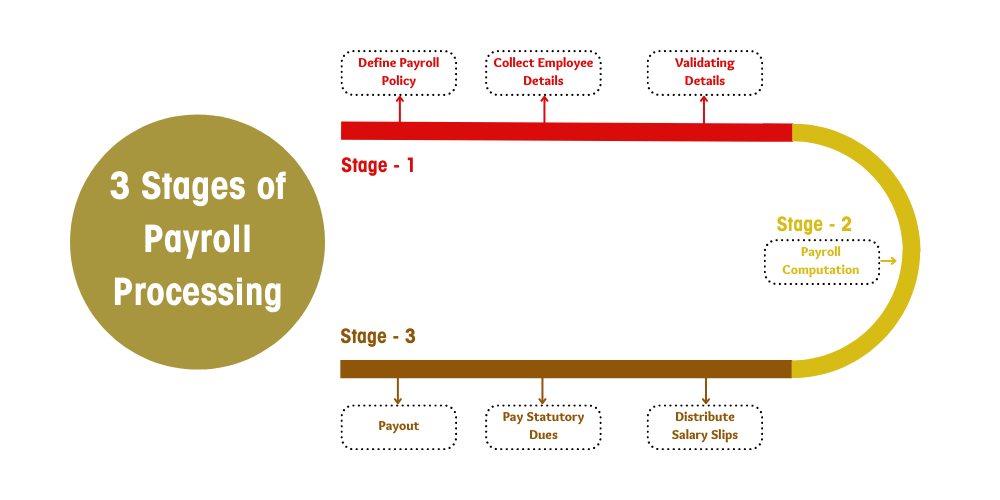

As we discussed earlier, there are a host of steps involved in payroll processing. They are as follows:

This is the first and foremost step of payroll processing.

In this, companies define their policies and get approval from the management to carry out excellent payroll processing.

For the unintended, the policies we mentioned above include pay policy, leave & attendance policy, and much more.

By the title, you must have got an idea of what this step is all about.

To process the payroll accurately, companies must acquire the correct details of every employee.

Now, different companies ask their employees to provide different details. However, the following three details are must for effective payroll processing:

Not to forget, companies are supposed to collect these details from employees at the time of their joining.

Just collecting inputs from every employee is not enough. Companies must also validate the same with respect to their policies as well as approval models.

This step is all about using the validated details of employees for processing payroll.

All HR managers need to do is put the validated input to the system they use and calculate the payable payroll of every employee.

Need to mention, HR managers and employers should only consider active employees and keep former working individuals away from payroll & compliance payments.

Payroll computation has always been carried out using traditional tools such as excel sheets.

Since working with such outdated tools/systems is time-consuming and painful, businesses have started investing in automated payroll processing systems.

Such systems make this step error-free, faster, and less tedious.

Once the payroll of every employee is calculated, the very next step is to transfer the same to their accounts.

Traditionally, companies relied on the bank to pay out the employee payroll. However, this step has also become super easy with automated payroll software.

With payroll systems, HRs can now pay employees in just a few clicks anytime, anywhere, using any device.

While processing payroll, companies deduct provident funds, TDS, ESI, and much more.

Companies are liable to pay these payments to the respective govt. departments within a stipulated time.

If not done properly, this step can cost a considerable amount of money to an organization and even lead to legal problems.

Last but not least, the whole process comes to an end when companies distribute salary slips to employees along with their tax computation sheets.

All these seven steps can be completed effortlessly with the use of one of the best payroll software in India.

Payroll software is an automated solution that helps companies to simplify their payroll processing.

From defining payroll policies to sending salary slips, online payroll software makes the whole process faster and easier for HR managers.

It is after the outbreak of the Corona pandemic, that more and more companies in India started embracing payroll automation.

Automated payroll processing systems come with a number of advantages. Such solutions not just empower HR departments but also save time for them to concentrate on value-adding activities of the business.

Many people presume payroll systems only aid HR managers; however, this is not true.

Payroll management systems empower each and every working individual in a workplace.

While it supports HRs to process payroll without an error, it helps employees to do several things on their own.

In simpler words, payroll software also fosters a positive work environment.

To solve your payroll problems and ensure smooth payroll processing, you must get your hands on the right online payroll software.

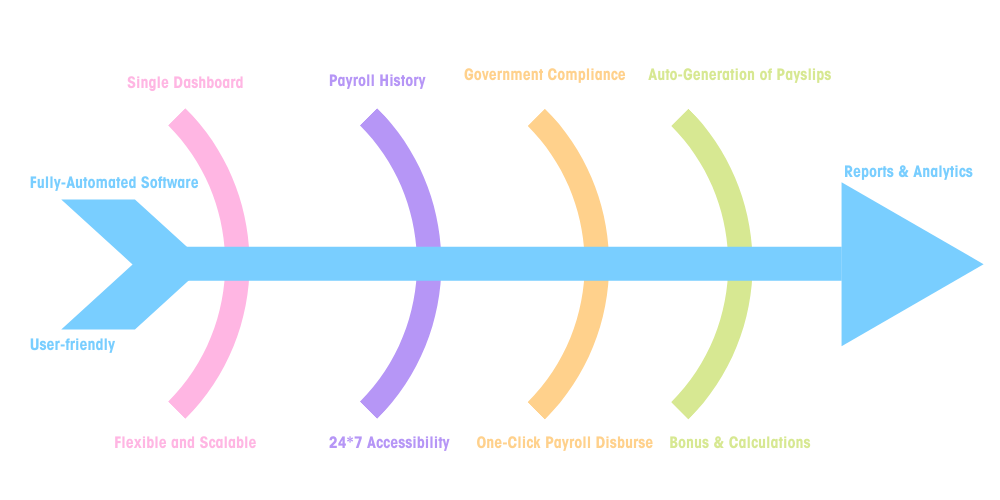

This is when a question comes into the picture- what factor makes a payroll system best for you?

The answer is simple- its features.

So, here are the must-have features you should consider while choosing a payroll processing system:

If your payroll system has all the features listed above, you will never be left behind the curve.

Note: You can invest in UBS software- a well-known hr payroll software that offers all these features and more.

How to Fix Stressful and Time Consuming Payroll in your Company?

Gone are days when payroll processing was all about endless paperwork.

We live in the automation era, and it is high time for every business out there to consider payroll software over other outdated tools.

We hope this blog convinced you to embrace the power of payroll automation at the earliest possible. Go for it!!!

We are here to help you find a solution that suits your business need.

Get a visual representation of how we work!

Schedule DemoOur sales expert is just one call away to meet your needs.

Get In TouchHave a question?

Chat with Us