UBS App is now Superworks

Let’s say you are eager to run payroll software for your small business. So, let’s begin here. When it comes to payroll software, it isn’t just something built for small businesses. All the aspects of business management software include features that can help you understand the ins and outs of the payroll system. Your craving for an idealistic approach to run hassle-free payroll processing has brought you here. And, we can help you accommodate several pieces of information and knowledge. It will only help you understand payroll management software, which is most of the time actually a part of HRMS.

Moreover, in this article, we have tried to cover all the different queries you can research regarding a payroll platform. It is better to know thoroughly about any software or even a product before we start investing in it. In the end, you may realize how effective a payroll system is, and if at all, it is suitable for your business. You can also evaluate how suitable the product is for your company.

The term payroll itself is associated with several different prospects. Out of these, one of the most important ones is the calculation and organization of the earnings of employees of your company. Payroll processing is basically an operation that includes a certain number of tasks starting from onboarding to establishing and discussing payment policies. It also includes gathering different payment options, calculating and verifying payout, processing salary, and distributing payslips. Moreover, tax filing and accounting are also included in the payroll processing.

When it comes to HR software, payroll is used to manage your employee’s financial records. It is simple and works in an automated fashion. The payroll management system in HR software manages employees’ salaries, deductions, other conveyances, overtime, bonuses, and payslip generation.

A Payroll system with HR software eases the hassle of managing vast data of incoming and outgoing employees. It helps you keep track of the billable hours. As the employee work hours are easily tracked you can streamline the payroll-related operation. Moreover, it enables the administrator to pay salary on time and make sure no calculation mistakes are made.

Even before you start investing in payroll management you need to know all there is to know about such a business management system. You can undertake any method described below that suits your business.

Nevertheless, you need to know there are various aspects to choose from to ensure smoother time tracking. Consider your convenience at the utmost. This shifting between different types of payroll systems, actually shows how they are the best fit for your business.

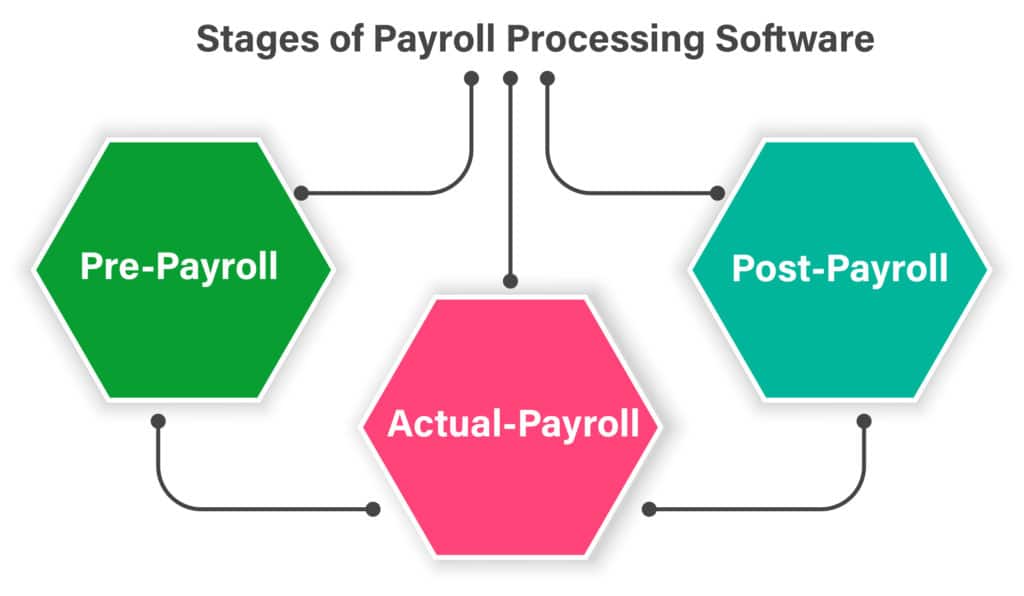

The payroll management process basically has three different stages. They are performed in the same order every month. In other words, you can say that the payroll process is a cycle. It is all about arriving at what is due for the employees, making necessary tax adjustments, and then processing the amount.

Here’s how a payroll cycle would look like.

When you see a payroll cycle and its different stages, you will come to know how important a process it is. Depending on the structure of the salaries, prevailing laws, and regulations, the calculation of payroll can be either simple or more complex. When it comes to payroll processing, you need to make sure it takes place in a timely and accurate manner. Any discrepancies in the calculations have a direct impact on employee morale and productivity.

Apart from the time management and leave calculations, it also involves compliance with the regional laws and regulations. If there are mistakes regarding the compliance of these rules, it could put the organization into legal trouble. Different stages of an accurate and effective payroll process are essential in any organization whether it is a large scale industry or a small scale industry. Using project management software with capabilities to manage payroll in a stepwise manner makes the entire process simpler and error-free.

To know more about the process of Payroll in detail, click on the link below.

The Ultimate Cycle Of Payroll Processing Through Software

Here are some key points to keep in mind to have a smoothly running payroll process:

When you have already understood the payroll process, don’t you think it would be much better if you have payroll processing software to help you run this process smoothly? After you lock and run payroll for a month, reports such as department-wise and location-wise employee costs should be analyzed. They are analyzed to plan wor-flow for the next month.

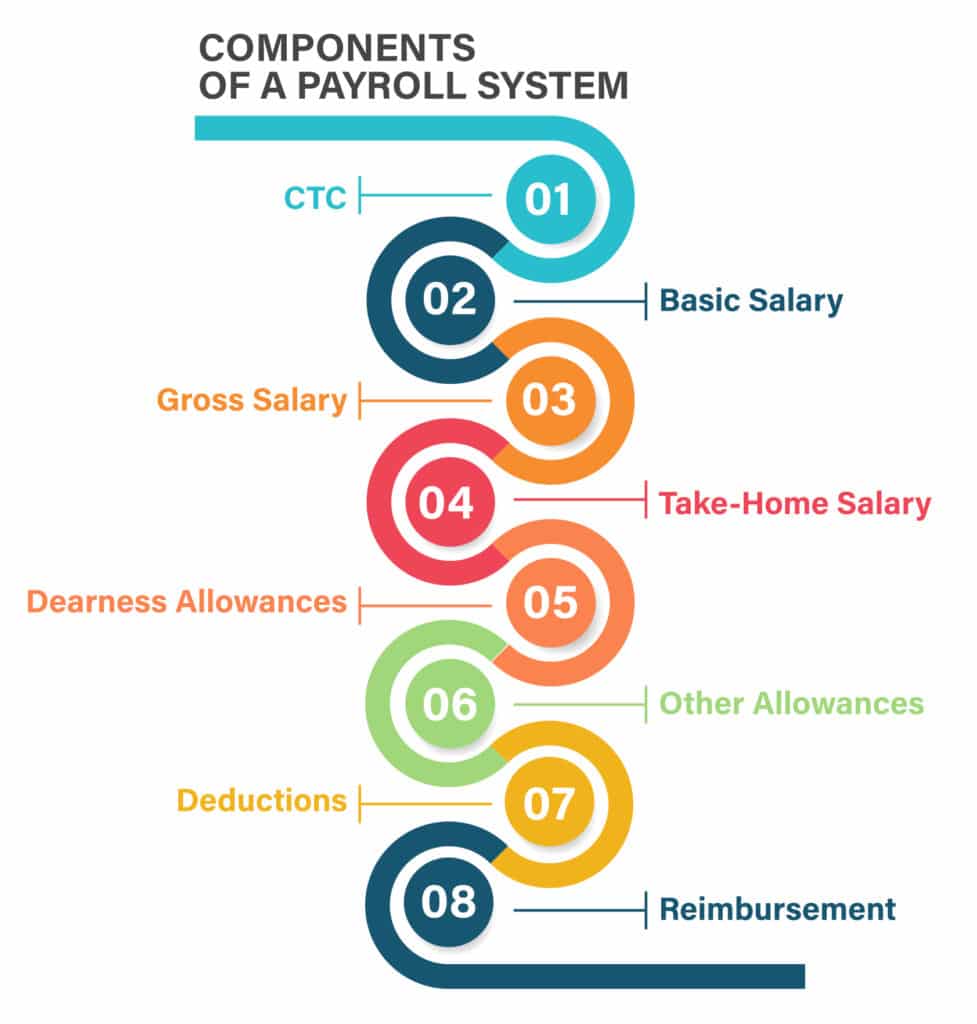

But, you will need to learn about the composition of such a process. Right? Let’s walk sour way through different components of payroll software.

As we discussed above, the flow of different processes included in the payroll management system, we must take into consideration that there are different components in payroll processing. The monthly disbursement of salary and employee wages depends on their components. Between the gross salary and the net salary, these collectible components are absolutely necessary.

A payslip or a salary slip is a stamped document that brings in the details of monthly payout, employee id, and net payable amount. It is concerned with the amount deposited in the employee’s account. A Payslip is used to keep a record of the employee’s salary information including Basic pay, Dearness Allowances, Bonus, Gross Pay, and Net Pay. It is also proof of the employment of the individual.

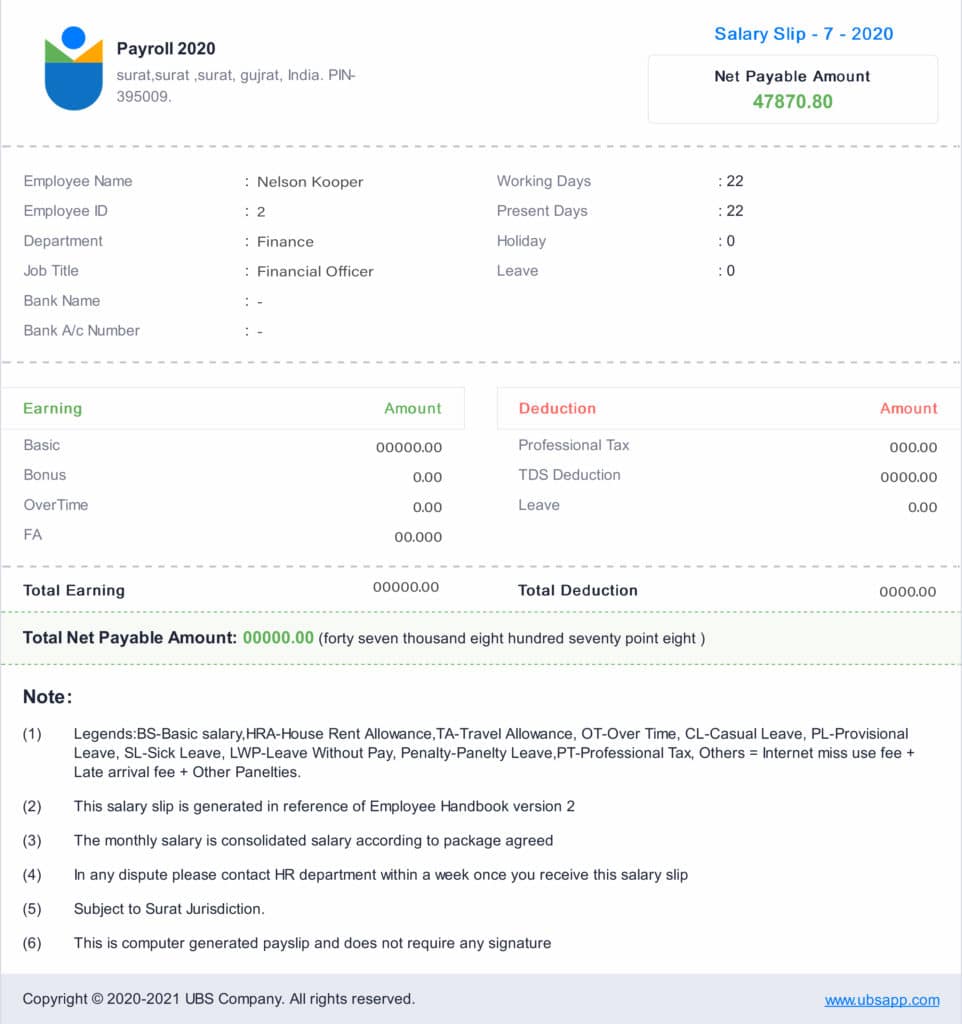

Here’s how the Payroll software dashboard at UBS will look like.

As you have already understood the basic definition of payroll, its importance in HR, and its components, let’s find out how a payslip on UBS HRMS will look like.

The payslip in HRMS can be downloaded in a pdf. The number of components and breakdown of each element can be seen easily. Companies can have advanced HR automation systems for the payroll process.

To help reduce manual labor and increase the efficiency of the existing employees, an automated payroll system can help in a lot of ways. Payroll software can help you streamline your payroll process and make sure you have your payment on time and accurately.

Payroll software is a source for all your records. How? Well, For instance, It definitely saves your HR staff from manually keeping records. Some of the records may include employee contracts, pay rates, deductions, and work hours. Physical data presence with paper and files takes up a lot of storage in an office. Moreover, don’t you think it is a quite challenging process?

A payroll system comes with all the functions to save both stress and space for you. Most of the features that you will heave in an HRMS software will help you in ways you can not scale. Payroll software is a handy tool for HR managers. A lot of payroll management services provide self-service dashboards. With the help of such software, it becomes a negligible task to handle employee data. They can keep a track of their work hours, pay rate, benefits, and other details. This way, employees can quickly check details and get to editing when required. This will reduce the errors on the part of your employees.

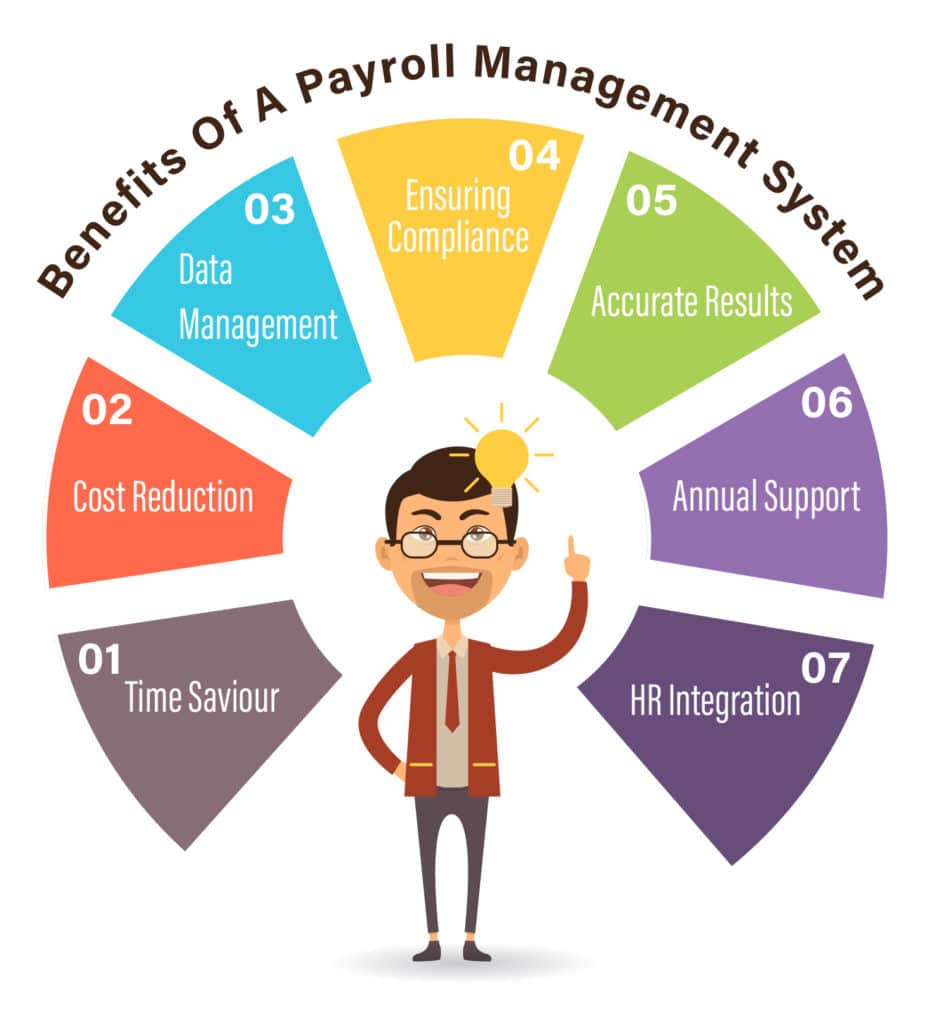

There are different benefits of payroll software to an organization. However, you need to make sure you find the right payroll software that fits your business. Here are some of the benefits of payroll software.

Even with all the benefits that come with such an integrated payroll management system in an HRMS, you will have some challenges. Let’s understand those in brief.

Payroll management is a complex process that expects your HR team to consistently stay aware. Moreover, if you have a manual payroll management system, it becomes more and more difficult. Processes like employee attendance and the financial flow of the office have to be kept up to date. However, whether you are just starting out or in the business for a long time, these processes can easily take your focus away from the core business procedures. The reason behind this is the challenges in handling the payroll management process.

Some of the great challenges include the following key points

It may look like an easy job, however, calculating payroll and dispatching salaries is a must. When you keep a check on reality, there are various challenges in the payroll processing system. For example, higher costs, inaccuracy, non-compliance, etc.

Read along this article to know more about the challenges in payroll processing along with the solution to mitigate these issues.

When times get tough for a small company, cuts need to be made for survival and to see how growth can be taken into consideration. Payroll generation and managing employees according to the respective time spent is often one of the biggest expenses for a business. Like we already discussed, Payroll management could be a hassle if not done appropriately and accurately.

To reduce the delay that occurs during the payroll processing can actually affect each and every staff member. Undoubtedly, labor cost is still one of the most considerable expenses every employer faces periodically. Surprisingly, it is perhaps the most poorly tracked expense in your workplace. As your organization grows, you can introduce payroll software. This can have a drastic impact on revenue, especially if you’re a start-up or small business.

A large chunk of your budget is always spent on payroll management tools. Companies can reduce payroll costs by merely decreasing the wages and firing the employees. But this can have adverse effects in terms of poor morale, cold customer relations, and maybe reduction in sales.

So, what can business leaders do to reduce payroll management costs without affecting their employees and customers?

Today, many organizations are tackling this problem with the help of technology. Still, many are unaware of it. Automating payroll reduces manual paycheck errors, which can then reduce costs related to payroll by as much as 80%. Automation is one of the easiest ways to reduce payroll costs since it saves you money and time.

Top 3 Fair Ways To Reduce Payroll Management Costs

You can manage your payroll d\generation with a single software. It can be as low as 50 rs/month. Depending on the features you need to integrate into your software, the prices may vary.

This all depends on how many employees you have at your organization. If you want to manage it yourself it is financially the cheapest. However, it takes minimum charges per employee per pay period for every employee.

Each employee costs the sum of his or her gross wages. This is in addition to other employee-related expenses which include payroll taxes, reimbursement, and medical expenses, and the cost of benefits.

Paying an employee literally means it is the compensation an employee gets paid, no matter how much they value their job role. Apart from the salary, employees want recognition for the hard work they do every day.

“A person who feels appreciated will always do more than what is expected.”

Compensation for the true value of work done by employees is a great thing to be considered by every organization. If an employee is rewarded for their extra effort or new initiatives, they feel valued and honored in the organization. To add to it, flexible payroll suggests that your workforce is paid accordingly.

Therefore, it is quite obvious now that payroll teams are significant contributors to positive company culture. If you don’t have an efficient payroll team by your side, chances are, you will face the threat of a bad reputation and lack of employee engagement.

Are you looking for a great payroll system? A single system that can help you attend, leave, and payroll management? Well, get a demo with us at UBS HRMS and redefine your payroll processes!

Stay Up To Date With Business Growth Tips And Tricks With UBS

We are here to help you find a solution that suits your business need.

Get a visual representation of how we work!

Schedule DemoOur sales expert is just one call away to meet your needs.

Get In TouchHave a question?

Chat with Us