UBS App is now Superworks

While outsourcing your payroll processes to a payroll services provider, you can run your company’s payroll on your own.

How?

So, are you still using pen and paper-based payroll processing? Those complex calculations, hectic record keeping, and manual management. Don’t these activities consume most of your month-end time?

So, why stick to manual payroll processing? Get it automated with the best payroll processing system.

Surf through the blog. We have tried to answer all your queries about payroll processing and how automation can help you save time.

Let’s get started!!

Payroll is the process of paying salaries to the employees of an organization. It starts with making the list of employees to whom the salaries are to be paid and ends with recording those expenses.

The payroll process means calculating what is due to the employees for a specific pay cycle after calculating all the deductions like PF, TDS, meal coupons, etc. The payroll cycle is the gap between two salary disbursements of every employee. In India, generally, this pay cycle is on a monthly basis as most companies pay their employees monthly.

A payroll process needs different teams such as HR, payroll, and finance to work together. However, due to modern technology, the cost of these resources has been cut down with the help of payroll software. Now companies can easily manage all the payroll processing complexities.

Payroll processing software is an on-site or cloud-based software that manages and automates processes related to salary payments to employees. This software can be available in the form of a standalone system or can be in the form of a large-scale HRMS suite just like UBS Payroll Software.

Payroll software in India can be customized to match well with the needs of startups, SMEs, or big corporate enterprises. While a few features may differ as per the size of the company, the main purpose of payroll software is the same – processing the salaries of employees on time and accurately.

Payroll Calculation in India is not as easy as it seems. There are so many elements that are to be adjusted while calculating the payroll of the employees.

An important element of a salary structure in India includes:

The payroll is calculated by using all the above applicable elements with a formula.

The Formula:

Net Salary = Gross Salary – Gross Deductions

Where,

Gross Salary = Basic Salary + HRA + Other types of Allowances + Bonus + Arrears + Reimbursements.

Gross Deductions = Public PF + Professional Tax + Insurance + Income Tax + Leave Adjustments + Any Loan Repayments.

The above was the basic formula to calculate employee pay. However, that is not it. There are various stages to payroll processing.

Do you know the Payroll Processing Stages in India? If not, we have got you covered.

Read further to know more!!

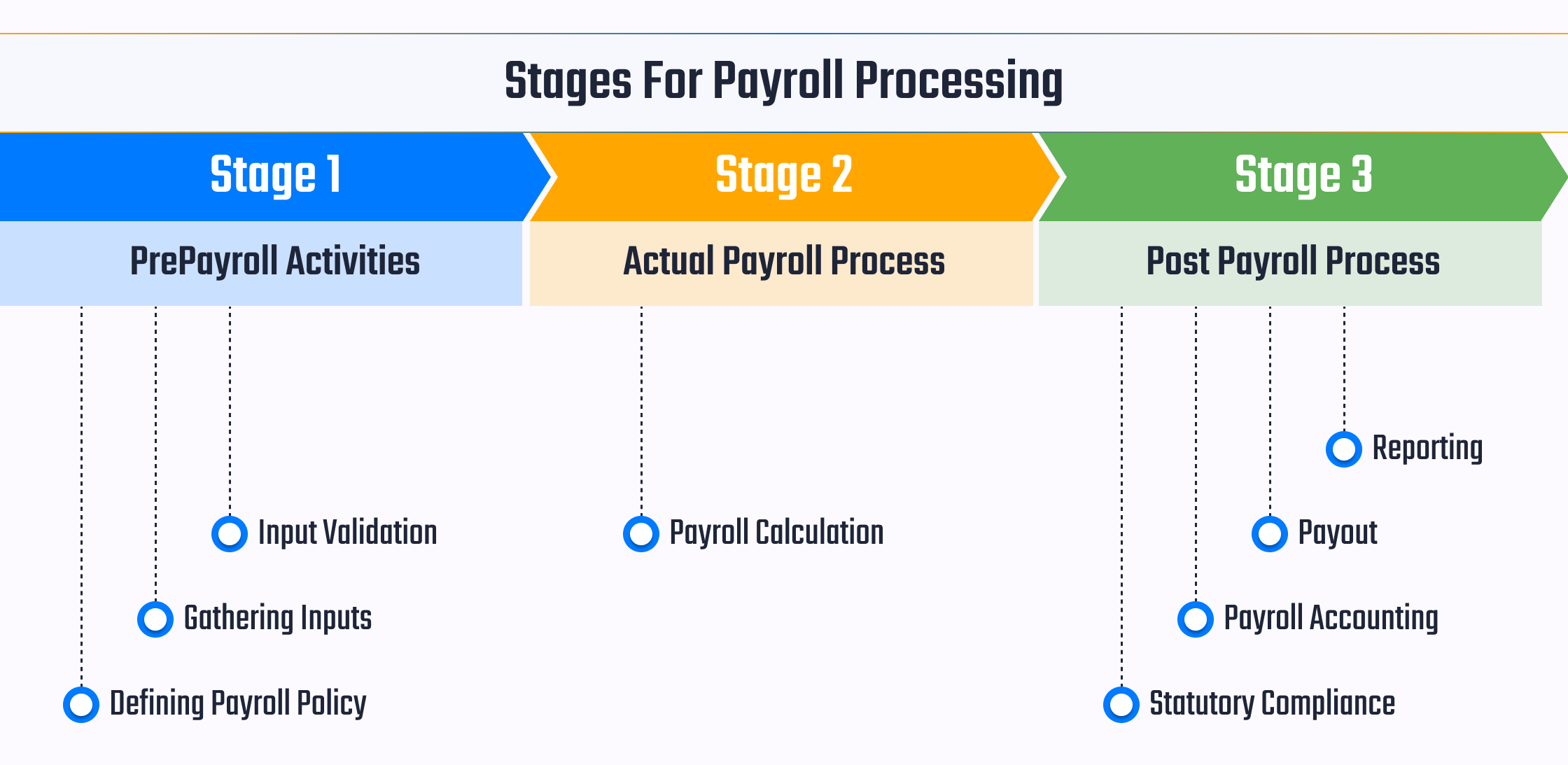

The entire payroll process is divided into 3 stages: Pre-payroll activities, Actual payroll process, and Post-payroll activities. This blog discusses every stage in detail. Read to know more.

In Stage 1, the very first step of the payroll process is to define the payroll policy. In this step, you establish the policies for the bank during the payroll process. In order to turn these policies into standards, they are to be approved by the management. The policies include a leave and benefits policy, an attendance policy, a pay policy, and more.

To run the payroll department with ease, companies need to have an established payroll policy in place and ensure all employee payments are done accurately and on time.

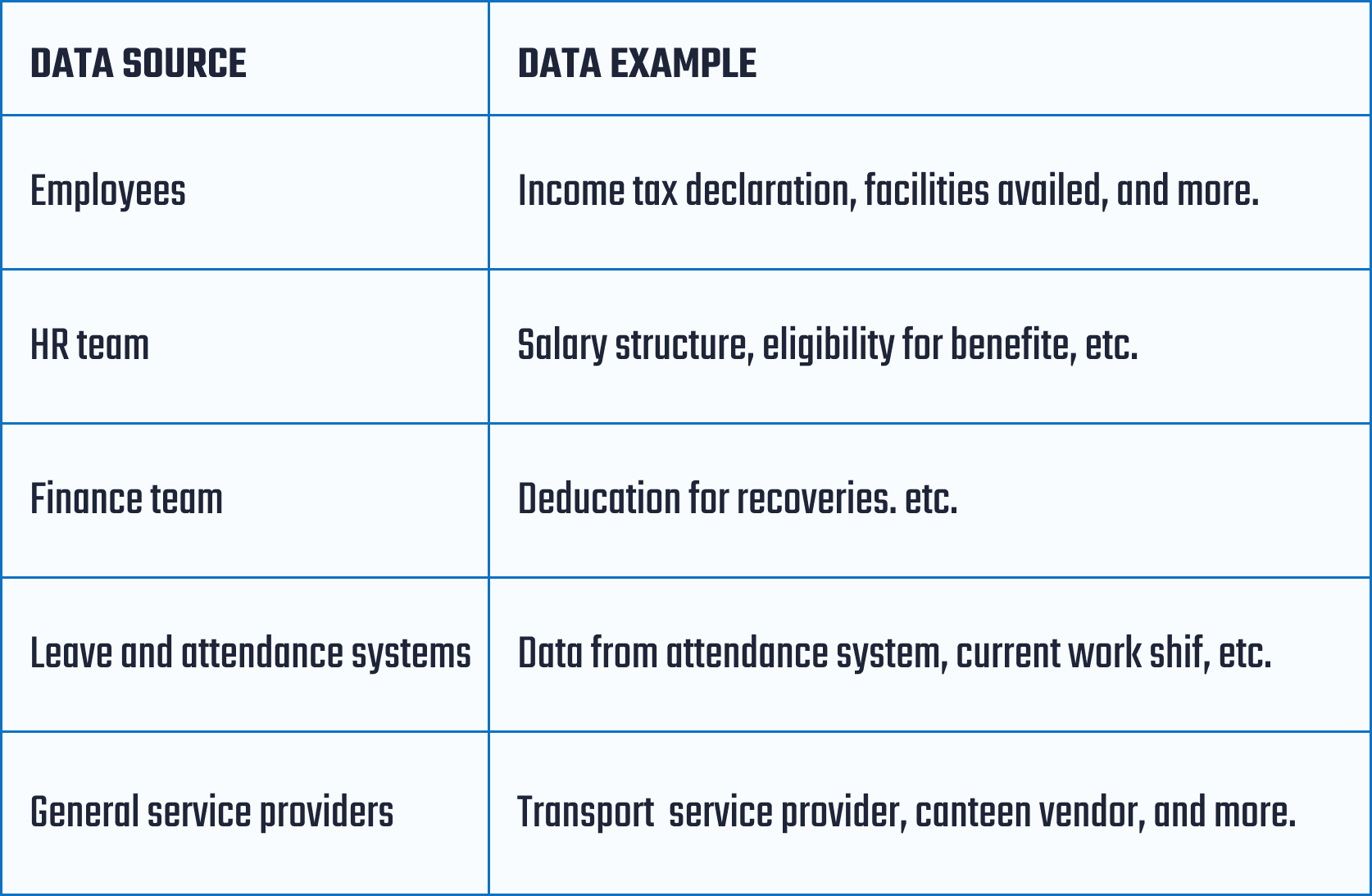

In step 2 of stage 1, you need to collect the data from various departments to ensure accurate payroll on time.

All this data collection may look like a complex task at first. But to get it simplified, you need to implement payroll software at your company. UBS – a payroll software in India that consists of features like leave and attendance management, an Employee self-service portal, and many more to make your payroll task simplified and avoid errors and delays.

Validation is important to ensure accuracy. Therefore, once you have gathered all the data, you need to verify its validity. Because a single error in the payroll data can ruin the entire payroll process. For an accurate payroll process:

Now that the data verification is done, you can now feed it into the payroll system. The result you get will be the net pay after all the necessary deductions and taxes. In stage 2 of the payroll process, you check the entire process again to nullify the chances of any errors.

Payroll System!! What is it?

A payroll system is software to automate the payroll process. These systems come in two forms: a standalone payroll system and an integrated payroll system. The integrated payroll system is combined with the attendance and leave management system and employee self-service portal. It is used to keep track of employees’ leaves, and working hours, calculate salaries, taxes and deductions, print payslips, etc.

An efficient payroll processing system thus reduces the employer’s efforts so that they can focus on the other core business operations.

This step comes under stage 3 of the payroll process. In this step, the payroll administrator needs to necessarily stick to statutory compliances. This step adjusts various statutory deductions including – ESIC, PF, EPF, TDS, and more. These deductions are then paid to the respective government bodies.

Every organization, be it small or big, needs to maintain a book of accounts and one of the most significant entries of this is the salary paid to the employees. Therefore, during the payroll process, all the significant data must be fed into the system.

After the successful completion of all the above steps, finally, the salaries are transferred through cash, cheque, or bank transfer. Organizations mostly prefer having the salary accounts of the employees for hassle-free transfer.

For paying salaries through bank transfers, you need to send the salary bank account statements to the branch. The statement includes details like employee ID, account number, salary amount, and more.

Reporting is the last step of the payroll process. In this step, you need to prepare accurate reports with information such as department/branch-wise employee costs. For further accurate analysis, these reports are sent to the financial department or the management team.

| Sr. No. | HRMS/Payroll Software | Excel Sheets |

| 1 | Cloud-based software, dynamic in nature, updated changes can be seen by everyone at any time. | Every sheet needs to be manually uploaded to the cloud if you want to share it with people. |

| 2 | Centralized system for all activities, dashboards for every user, centralized data management. | Here there’s no dashboard feature. |

| 3 | Auto-generated reports | The HR/Financial department needs to create the reports manually. No automation. |

| 4 | Its process-oriented feature guarantees accuracy. | Because it is people-oriented, excel sheets are prone to errors. |

| 5 | Automated Compliance – A payroll software brings accuracy to tax calculations and ensures legal compliance for your business. | Compliances are managed and updated manually. |

| 6 | Customized access controls. Organizations can implement hierarchy. | There is no hierarchy. If you share a document, the entire information is shared with everybody. |

| 7 | Payroll software is easy to integrate and configure according to the company’s policies. | Excel provides standard features for all types of industries. |

| 8 | Payroll Software is safe as it schedules daily backups. Consolidated and systematic data management. | No automated data backup facility. Scattered data. |

Processing payroll requires a lot of time. It also incorporates numerous departments. Companies develop logical ways to bring the departments together in order to make the entire process seamless and interesting. Given that you are familiar with the fundamentals of payroll processing, you can utilize this knowledge to reevaluate and enhance the procedures employed by your company. Additionally, if you work as an employee, reading this page will assist you in understanding the procedures your payroll department follows before disbursing your net pay.

Try UBS HRMS and Payroll Software right away to experience payroll compliance automation like never before. If you want to spend your valuable time managing your company’s core operations rather than worrying about the required payments, UBS is the home for your payroll processes.

You can experience end-to-end automated payroll processing with just one click. Book demo.

The payroll process in India is divided into 3 different stages: Pre-payroll activities, actual payroll process, and post-payroll activities. The above blog explains all the steps involved in these 3 stages of payroll processing.

The payroll processing steps include defining payroll policy, gathering inputs, input validation, payroll calculation, statutory compliance, payroll accounting, payout, and reporting. Read the blog or get in touch with UBS to know more.

A full cycle payroll processing is the gap between two salary disbursements. Organizations can choose to pay the salaries on a weekly, bi-weekly, or monthly basis. Generally, companies in India prefer to pay salaries on a monthly basis.

We are here to help you find a solution that suits your business need.

Get a visual representation of how we work!

Schedule DemoOur sales expert is just one call away to meet your needs.

Get In TouchHave a question?

Chat with Us