UBS App is now Superworks

What’s the first thing that comes to your mind when you hear payroll processing? Is it those long hours of calculation, the anxiety of payroll errors, or scrolling through payroll data?

For any business, be it startups, SMEs, or MNCs, payroll stress is a monthly pain point. From computation to complying with the latest legal requirements, tax, and other contributions, every step in the payroll process takes a considerable amount of time and investment.

Payroll processing may sound easy, but HRs know the actual struggle they face every month.

If you are an HR manager who wants to overcome those challenges, just dive into the blog!

There is no point in discussing the challenges without knowing the meaning.

So, payroll processing is a crucial business operation that includes computing the NET PAY of an employee after making all the adjustments of several taxes and deductions.

To ensure effective payroll processing, HR executives must plan and execute the whole process step-by-step.

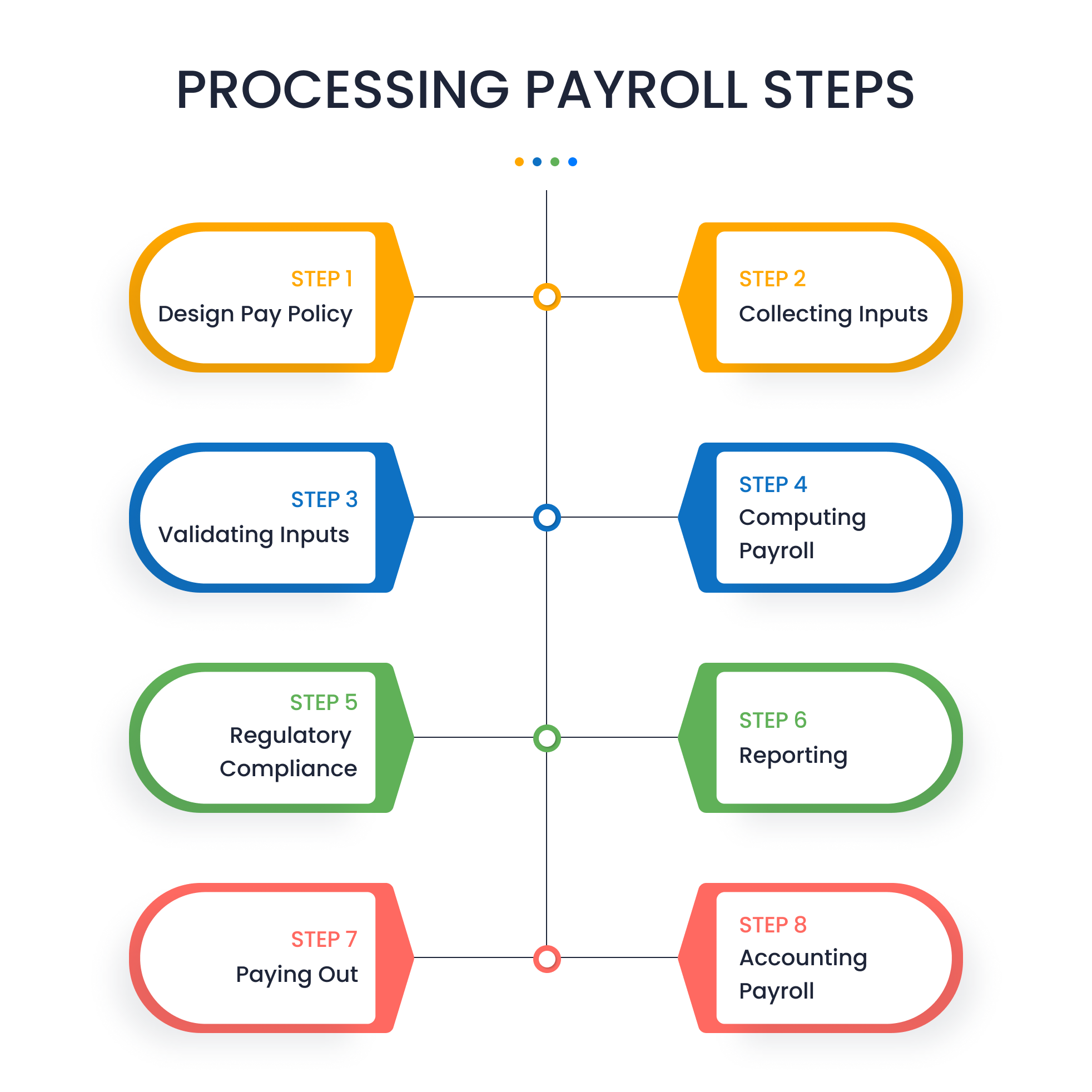

That being said, here are the steps involved while processing payroll:

Needless to say, all the steps mentioned above are equally important.

Let’s face it, every working individual waits for his/her salary day very eagerly.

No matter how good the work environment is or how supportive the management is- employees tend to get disappointed when their salaries are not credited on time.

In simpler words, ineffective payroll management can directly affect the morale as well as engagement of employees. This is why payroll processing is significant for every business.

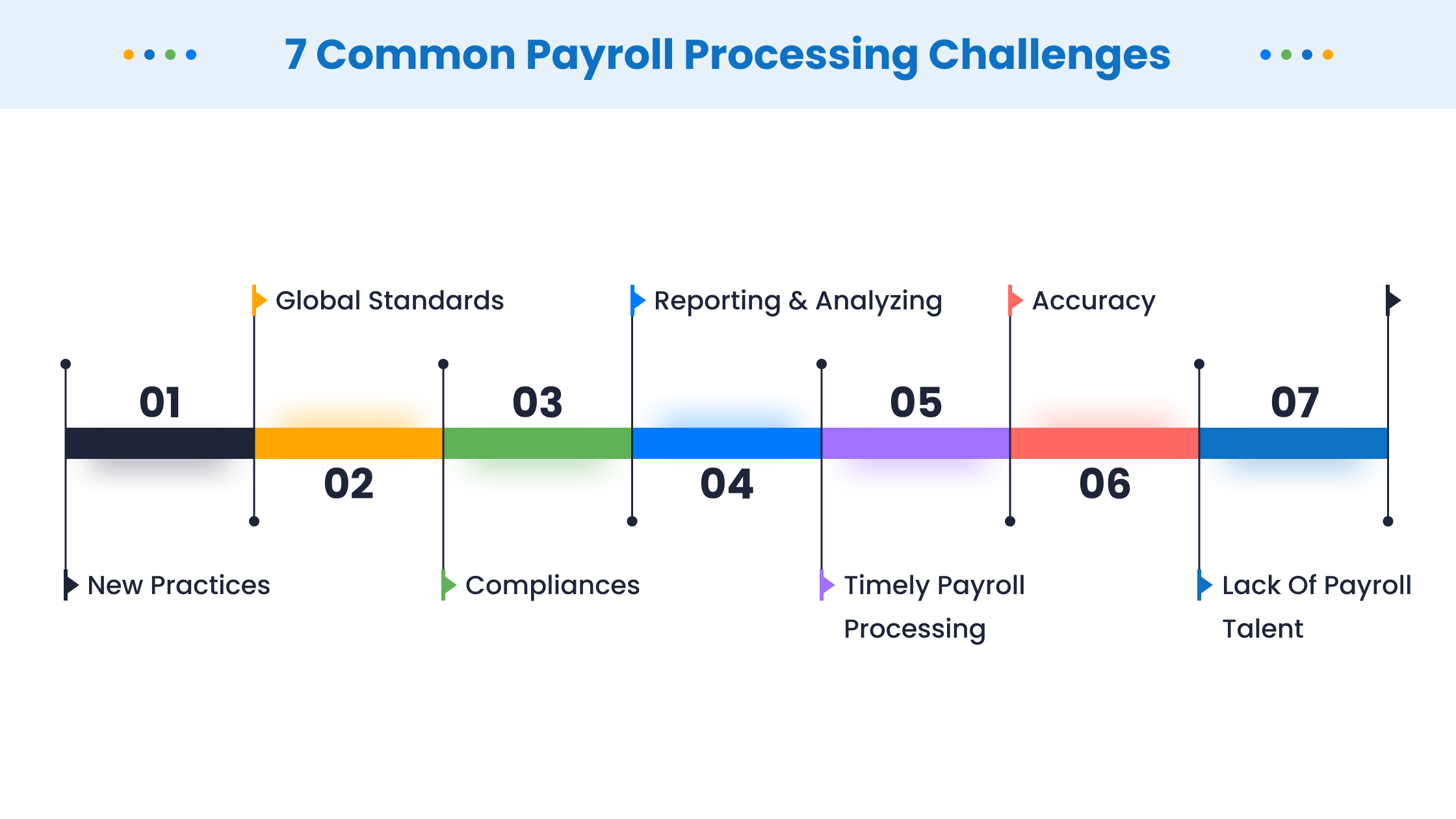

Now, let’s learn how companies can overcome these seven payroll process challenges effortlessly:

Businesses that want to expand globally will go through several changes along the way.

To withstand those changes, HR professionals should redesign their routine functions and practices, including payroll, in a way that will suit their global clients and needs.

Additionally, HRs should promptly communicate the modified practices to the employees to ensure transparency.

In the process of expansion and growth, companies will not just have to compete with global market standards but also a host of internal local challenges.

Investing in payroll software is the best solution for this challenge. Top-notch software such as UBS helps businesses to standardize their payroll both globally as well as locally.

It is no news that laws and regulations keep changing everywhere, and keeping up with such changing legal requirements is easier said than done.

Ensuring compliance can be made easier with a good payroll system. Since such systems come with auto-alerts, HRs will be promptly updated about the latest statutory laws and amendments. This will leave no room for non-compliance issues.

Reporting and analyzing have become even more significant over the past years.

Companies that collect, manage, and examine data can acquire ample benefits, including an improved bottom line. However, we cannot overlook that reporting and analyzing is one of the most painful tasks.

Fortunately, automating the same can help HRs to a greater extent and even save a large chunk of their time.

As we already mentioned in the beginning, employees start feeling disengaged and demoralized when they do not receive their salaries on time.

While businesses scale up, the routine processes also increase and become quite challenging. Amid managing a lot of other tasks & operations, HR professionals can lose track of things.

This challenge can be easily solved if HR managers learn to prioritize tasks. If things are still complicated, payroll software is always there for the rescue.

Don’t you already feel bad for HR problems? They have so much on their shoulders and still are expected to avoid even a slight mistake.

Truth be told, humans tend to make mistakes. But, at the same time, payroll errors can result in hefty penalties and even lawsuits.

Now, the easiest way to ensure 100% accuracy is to embrace payroll automation.

For successful growth, an organization also requires a talented bunch of payroll professionals.

By offering competitive salary packages, companies can easily attract the best payroll talent in the market.

Additionally, companies should also train and upskill their existing payroll talent by providing them with comprehensive training and the latest technologies.

All the aforementioned payroll processing challenges get even more difficult with outdated payroll systems.

Keeping the same in mind, every business should rely on new-gen payroll software. Today, there is no dearth of payroll software for small businesses or large companies.

Switching from outdated systems to automated payroll processing systems will, undoubtedly, make things convenient and robust.

We hope this blog helped you understand everything about payroll processing and the tricks to overcome the challenges you often face.

For companies with growth ambitions, payroll automation should be a proactive decision to stay ahead of the competition. Try it out, you may be surprised at what you can achieve in the long run!

Payroll management is the process of optimizing and handling employees’ financial records of an organization. It includes data related to employees’ salaries, bonuses, deductions, and many more. HR and payroll managers usually are responsible for carrying out this process.

Payroll processing, in particular, has three stages - 1) Pre-Payroll Activities- this stage includes defining payroll policy, assembling inputs, and validating the same, 2) Payroll Calculation- As the name suggests, this stage includes the actual computation and processing of payroll, 3) Post-Payroll Process- This is the last stage of the process that includes ensuring compliance, accounting payroll, paying out and reporting.

There is no special magic to learn payroll processing. But, a tip for effective payroll processing is to design comprehensive and well-defined payroll policies. It is the first and most vital step that can either break or make the rest of the payroll process.

The stages and steps remain the same in India. The only difference is that payroll policies differ from company to company.

The payroll processing system is a tool particularly designed to help HR professionals to streamline and process payroll. Unlike outdated tools, such systems require a bare minimum of human intervention. Since a payroll processing system does everything on its own, HR managers can save a lot of time and energy for other critical business activities.

We are here to help you find a solution that suits your business need.

Get a visual representation of how we work!

Schedule DemoOur sales expert is just one call away to meet your needs.

Get In TouchHave a question?

Chat with Us