UBS App is now Superworks

It is evident that the last couple of years has brought about diverse transformations in the HR industry. Among all the changes, the biggest one has to be the automation of HR processes.

Need to mention, payroll processing is the most common operation automated by hundreds and thousands of companies across India.

It is no news that the increased push for diversity in businesses, the global pandemic, and working from home made payroll difficult for many. As a result, a major part of the business world left behind traditional payroll processing and switched to payroll software. Such systems helped HRs calculate, manage and transfer payrolls from the comfort of their home.

Although a lot has happened and changed, many people out there are still hesitant about payroll automation. If you are also one of them, this blog is just for you!

Here, we will help you decide what is better for your organization- traditional payroll processing or payroll software?

So, without any further ado, let’s explore!

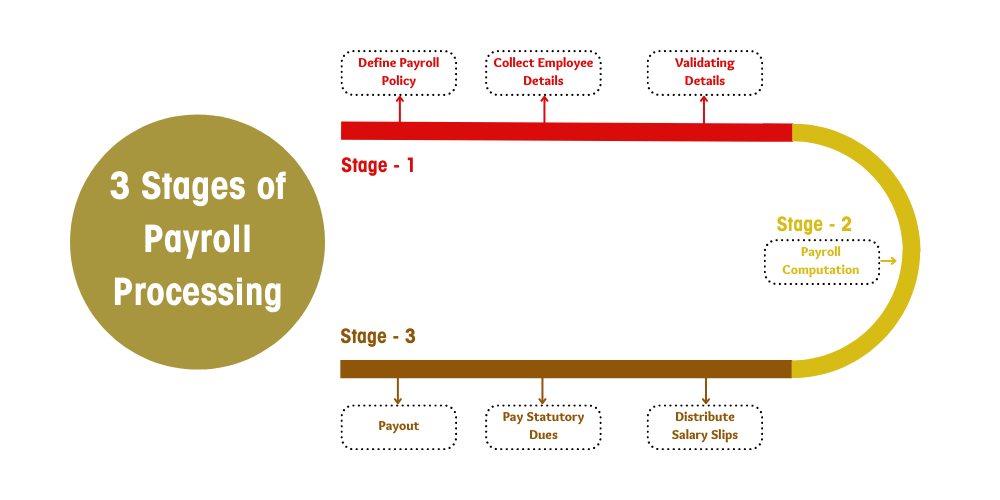

Before we start the comparison, let’s clearly understand the three stages involved in payroll processing.

The total payroll of an employee is impacted by numerous variables. Likewise, a host of policies like the compensation policy of the company, its attendance and benefits policy, etc are also considered while calculating payroll. So, the very first step of payroll processing is defining these policies and getting the same approved by the management.

While preparing payroll, HR managers interact with a host of departments and people to gather information related to payroll. From mid-year salary revision to attendance details, several details are required to compute payroll.

After collecting the data, the next step is to check its accuracy and ensure if it complies with company policy. At the same time, HR professionals also recheck if no existing employee is missed out or no inactive employee is included in the payroll. It is not as easy as it sounds- if HR misses a small error, it can lead to a huge loss for the business.

This is the most vital step of this whole process. One where HR managers use the validated data for the payroll computation. For the uninitiated, the net pay of every employee is calculated after adjusting the required taxes and several other deductions.

Every regulatory deduction is deducted while processing the payroll, i.e. the last step we discussed.

Organizations then send those deducted amounts to the respective govt. authorities. Need to mention, the frequency usually differs based on the type of the due. Most of the times, due payments are made through challans. Once a company pays dues, it files a return or report file.

Be it small or large, every company maintains a record of all its financial transactions. Out of all, payroll was and still remains one of the most critical operating expenses that should be documented in the accounting books.

After ensuring regulatory compliance, the very next step of payroll processing is feeding payroll and reimbursement information into the company’s accounting system.

Different companies pay out salaries via different channels. While some pay in cash, others rely on cheques or bank transfers.

The majority of the companies provide their employees with a salary bank account. After computing salary, HR managers make sure that the organization’s bank has enough funds to release everyone’s salary. If there is funds, HRs then share a statement containing all the payroll and employee details. Lastly, the bank releases the payroll on the specified date.

Once the whole payroll processing is done and dusted, higher authorities usually request HR professionals for specific reports like team-wise employee expenses, location-wise employee expenses, and much more.

In order to share these reports, HRs have to sit again, go through everything, and extract all the necessary information.

Now that you understand the whole payroll processing, let’s start the comparison for which you are here!

Payroll Software is the Future of Payroll: Read to Know More!

There is no denying that HR professionals have gotten a little too comfortable with manual payroll processing. Juggling with papers and scrolling down spreadsheets have become normal for them. But, there are several problems with traditional payroll processing.

Some of them are as follows:

Protecting payroll-related information from data misplacement, theft and leaks are acutely important. If payroll data get into the wrongs, it can have adverse effects on a business. Needless to say, the possibilities of data threats increase when companies use files, folders, and spreadsheets for recording and managing payroll data.

Managing payroll data in papers excels is not just prone to data threats but can also make things difficult for HR professionals. To acquire specific data, he or she will have to surf through piles of papers, which will certainly waste a good amount of time and energy.

Without a doubt, payroll processing is a time-consuming and labor-intensive operation. If it is processed manually, it will require a lot of resources that in turn will lead to higher costs along the way. Slowly but steadily, this will affect the bottom line of the business.

Manual computation is complicated and not a good option especially when it comes to tax calculations. If you are an HR manager, you will know that tax rules keep changing. And, if one fails to meet the latest updates, it can result in some hefty fines, penalties, and even legal consequences.

Now, let us talk about payroll software.

The one and the only problem with payroll processing systems is the transition part. The shift from manual to automation and getting used to the same can seem difficult to many. However, if you invest in a user-friendly system, you will not face that problem.

That being said, the benefits of using payroll management systems are literally many. Some top benefits are the following:

You just need to be mindful while selecting the payroll management system. If you opt for the best one, you will never face any challenges related to payroll.

Payroll Software for Small Businesses: Importance, Tips, and More

We have a clear winner here!!!

Drumrolls for payroll software, people.

Once you switch to a payroll management system, believe us- there will be no going back! You will definitely start enjoying the whole process of managing and processing payroll.

So, what are you waiting for? Switch to a top-notch payroll processing system today!

We are here to help you find a solution that suits your business need.

Get a visual representation of how we work!

Schedule DemoOur sales expert is just one call away to meet your needs.

Get In TouchHave a question?

Chat with Us