UBS App is now Superworks

EPF is a social security fund; it is enforced by the Government of India. As per the scheme employee and employer has to contribute some amount every month in the scheme for employee benefits. An employee can withdraw this EPF amount after retirement.

Note: This letter will be useful to you! You can edit it, as your needs and requirements.

When the organization is having more than 20 employees and the employee’s salary is less than 15,000 Rs. then the employer has to consider EPF. To enroll in EPF and withdraw, you need to consider many government forms. Form 11 is one of the important forms used in EPF.

Let’s dive in deep to know more about Form 11.

Form 11 is a self-declaration form filled out by an employee at the time of joining any organization. Form 11 is used where all the details of the employee’s EPF account have to be mentioned.

Earlier, the employee has to fill out form 12 for transferring PF to the new EPF account, but now it is now enabled to do by using Form 11. All employees who are members of the EPF with variables of Dearness Allowance (DA) of more than 15000 Rs per month should fill out the form.

What Is EPF Form 2? – Described General Info And Key Points Of Form 2

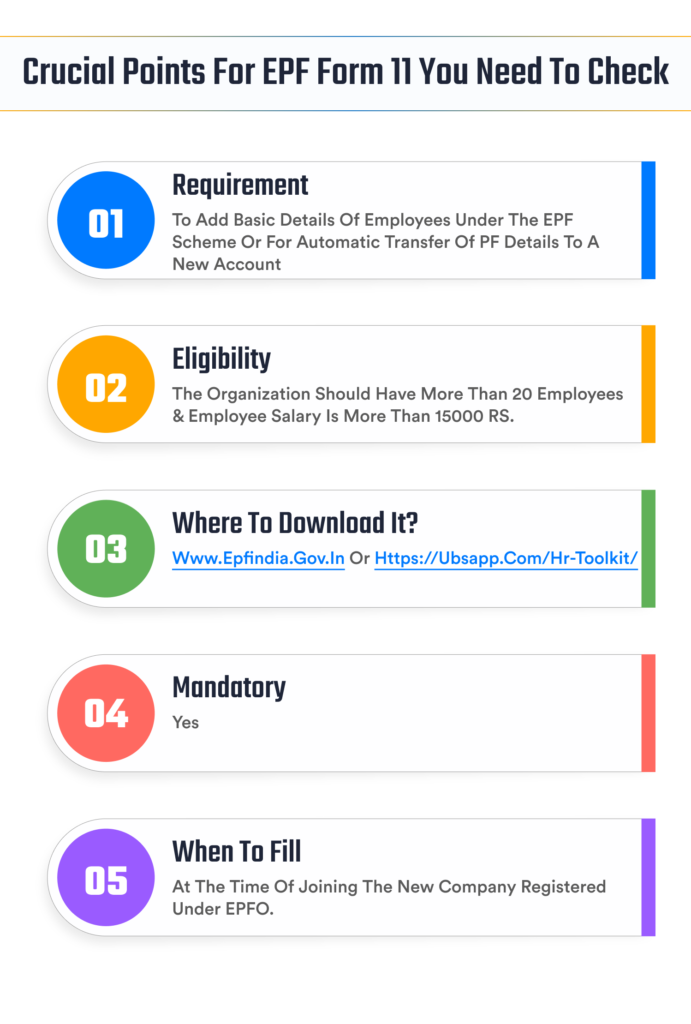

| Requirement | To add basic details of employees under the EPF scheme or for automatic transfer of PF details to a new account |

| Eligibility | The organization should have more than 20 employees & employee salary is more than 15000 RS. |

| Where to download it? | www.epfindia.gov.in Or https://ubsapp.com/hr-toolkit/ |

| Mandatory | Yes |

| When to fill | At the time of joining the new company registered under EPFO. |

This form 11 is necessary fields to be filled by the employee and a section called self-declaration by Present Employer’ which is to be filed by the employer.

Investment Declaration Form: A Brief About Form 12BB For Declaration

Hand Provident Fund Form 11 can be downloaded from the EPF website. The website link is www.epfindia.gov.in or you can download it from the UBS website.

You can download the Form 11 template from UBS HR Toolkit.

Note: This letter will be useful to you! You can edit it, as your needs and requirements.

Once you have filled out Form 11, submit it to the employer. The employer has to sign the form and puts his stamp on the form.

As an employee, when you are working in the organization you may get a good amount after retirement. EPF is the scheme where employees get benefits but for that right form or document is necessary.

Considering that, UBS provides the whole HR Toolkit library of HR forms and letters that helps employee, HR as well as employers to consider the right form, and format and make it easy to submit.

We are here to help you find a solution that suits your business need.

Get a visual representation of how we work!

Schedule DemoOur sales expert is just one call away to meet your needs.

Get In TouchHave a question?

Chat with Us